Australia’s economy bounced back in the third quarter

Dated : 02 Dec 2020 (IST)

Australia’s economic rebound in the third quarter was stronger than analysts had expected.

Australia’s economy rebounded sharply in the third quarter from a coronavirus-induced recession as consumer spending surged, though the country’s top central banker signalled monetary policy will stay supportive of growth for a while.

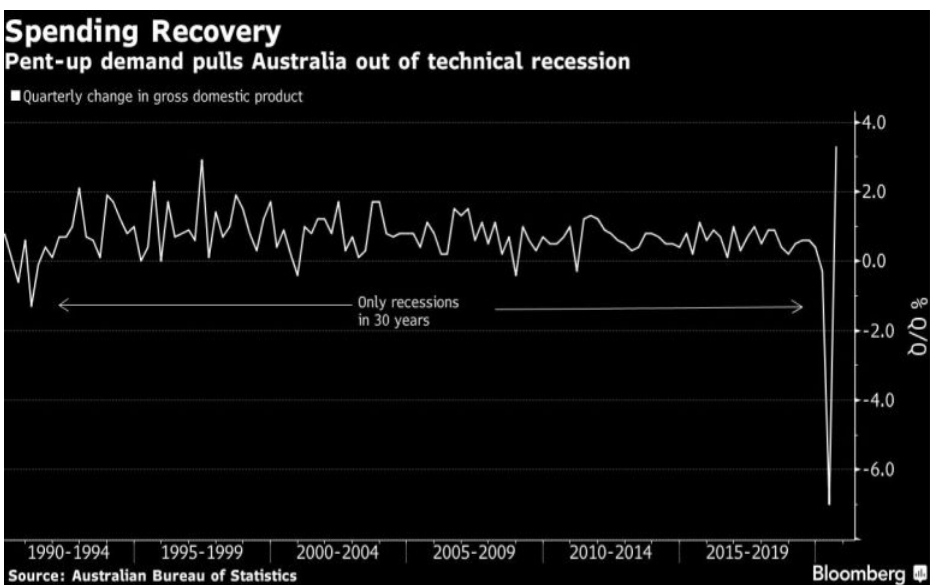

The latest data show that the 2-trillion Australian dollar ($1.5 trillion) economy expanded at a faster-than-expected rate of 3.3 percent in the September quarter, following a 7-percent contraction in June, as the country largely brought COVID-19 under control.

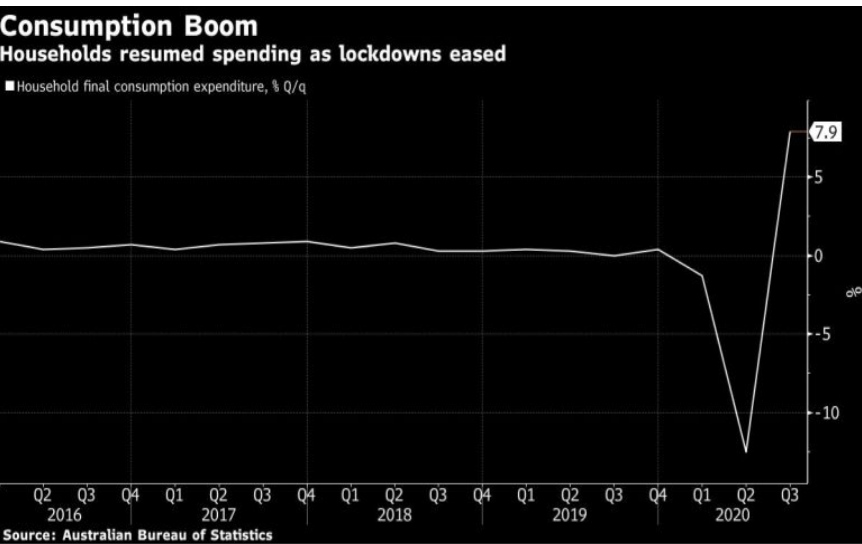

The rebound was led by household spending, which rose 7.9 percent, driven by aggressive fiscal and monetary stimulus programmes since March.

The Australian dollar briefly hit a day’s high of $0.7389.

Economic growth is expected to be “solidly positive” in the December quarter as well, Reserve Bank of Australia (RBA) Governor Philip Lowe said, underscoring the country’s success in curbing the pandemic.

Revenge spending

Top lender Commonwealth Bank reported a 12-percent jump in spending on cards for the week ending November 23 from last year while ANZ saw a 28-percent surge.

Australia is not yet out of the woods, as escalating tensions with top trading partner China hang heavily on the outlook.

Australian Treasurer Josh Frydenberg said on Wednesday the deteriorating trade relationship with China was a “very serious” matter though domestic consumption was key to Australia’s post-pandemic recovery.

China has so far curtailed Australia’s exports of lobsters, beef, timber, coal and wine though the broader economic hit is expected to be minimal as long as iron ore is spared, analysts said.

Agriculture exports account for just 0.02 percent of Australia’s annual output, while iron ore exports account for 7.5 percent of GDP.

“We expect some softening in tensions, especially given China’s multi-decade need to source key bulk commodities and metals from Australia,” said Paul Xiradis, chief investment officer at Ausbil.

Recession over?

Despite the brisk pace of quarterly growth, economic output is still down 3.8 percent over the year after Australia entered its first recession in three decades in the first half of 2020 due to coronavirus-driven lockdowns.

Lowe said the third-quarter GDP result was “good” but warned an economic recovery from the pandemic will likely be “bumpy and uneven” going forward.

“There is still a high degree of uncertainty about the outlook,” Lowe told lawmakers.

“We are prepared to do more, if that is required. Having said that, we are still of the view that a negative policy interest rate in Australia is extraordinarily unlikely.”

On Tuesday, the bank left its cash rate at a record low 0.1 percent and maintained its 100-billion Australian dollar ($73.85bn) quantitative easing programme. This involves the RBA buying Australian government bonds in order to inject more money into the economy.

Despite the measures, unemployment is still hovering above 7 percent, from about 5 percent before the pandemic, while inflation and wage growth are weak.

“Make no mistake, Australia is still functionally in a recession,” said Callam Pickering, economist at global job site Indeed.

“Both fiscal and monetary support measures will need to remain in place throughout 2021 and beyond to ensure that the recovery remains on track.”

SOURCE : NEWS AGENCIES