Trudeau’s Banks linked to mortgages for alleged mafia boss

Toronto Dominion Bank (TD) and the Royal Bank of Canada (RBC), two of Canada’s largest financial institutions, are under scrutiny for continuing to hold mortgages for Angelo Figliomeni, an alleged mafia boss tied to Italy’s notorious ’Ndrangheta crime syndicate.

This revelation comes amid heightened concerns over the banking sector’s anti-money laundering measures and reputational risks tied to criminal affiliations.

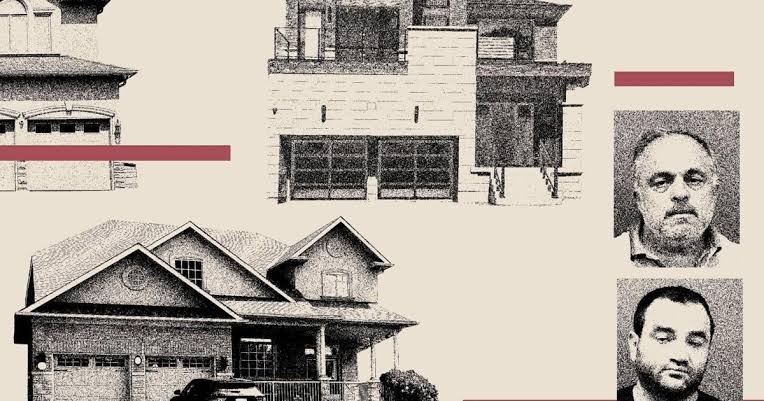

Property records reveal that TD and RBC are currently financing four properties in the Greater Toronto Area owned by Figliomeni.

These mortgages were initiated in the 2010s, a time when Figliomeni was already a known figure in Canadian and Italian media due to his alleged criminal activities.

Despite Figliomeni’s arrest in 2019 during what Toronto-area police dubbed the “biggest mafia takedown” in Canadian history, both banks maintained the mortgages. This decision is raising serious questions about their due diligence processes.

Figliomeni, along with eight others, was charged with offenses such as money laundering and other crimes related to organized crime.

However, the charges were stayed due to procedural issues, and no trial occurred. Figliomeni’s long history as a suspected mafia member and fugitive from justice in Italy did not deter the banks from continuing their business relationships with him.

Both TD and RBC have refused to provide detailed explanations regarding their continued financial ties with Figliomeni, citing privacy concerns. TD spokesperson Allyson Theriault stated, “On an ongoing basis, we complete account and product reviews, and address any situation where we can no longer support a client’s accounts.

”An insider at TD claimed that the bank began the process of “demarketing” Figliomeni after his 2019 arrest, aiming to terminate all his financial products, including mortgages.

However, there is no clarity on when Figliomeni’s mortgages will expire or if the bank plans to take further action.

RBC, Canada’s largest bank, echoed a similar sentiment through its spokesperson Cheryl Brean, who emphasized that the bank “continuously evaluates business relationships on a case-by-case basis.”

However, the lack of transparency surrounding their ongoing relationship with Figliomeni has only intensified public scrutiny.Gary Clement, a former superintendent with the Royal Canadian Mounted Police who specialized in financial crimes, criticized both banks for their apparent failure to conduct adequate due diligence.

“They took these mortgages out, which tells me right off the bat [the banks] never did enhanced due diligence,” Clement stated. “That should have been picked up right from day one.

These guys would have shown up on some alert.”Figliomeni’s criminal history stretches back decades. He was convicted in Italy in the 1990s for possession of illegal weapons and mafia-related activities.

In Canada, media reports dating back to 2006 linked him to criminal conspiracies in Italy and identified him as a mafia figure operating in Toronto. Despite such a high-profile reputation, both banks approved and maintained his mortgages.

This controversy unfolds as TD Bank faces a broader reckoning for failing to prevent money laundering. In October, TD pleaded guilty in the US to conspiracy to commit money laundering, leading to penalties totalling $3 billion-the largest ever imposed under the US Banking Secrecy Act.

The US Department of Justice revealed that TD failed to monitor $18.3 trillion in customer activity over nearly a decade, enabling more than $670 million to be laundered through its accounts.

At home, TD was fined CAN$9 million (USD$6.6 million) by Canada’s financial intelligence unit, FINTRAC, for similar lapses in anti-money laundering compliance.

This marked the largest penalty ever levied by the agency, underscoring systemic weaknesses in TD’s operations. RBC also faced a CAN$7.5 million penalty in December 2023 for failing to comply with anti-money laundering regulations.

The links between TD, RBC, and Figliomeni were first exposed during “Project Sindacato,” an investigation led by York Regional Police.

The operation targeted Figliomeni’s alleged mafia group and resulted in the seizure of over CAN$35 million (USD$27 million) in assets. The investigation also revealed that TD, RBC, and other Canadian banks held hundreds of accounts tied to Figliomeni’s group.

However, when charges against Figliomeni were stayed, all seized assets and frozen accounts were returned. This included 27 properties worth CAN$24 million (USD$18 million), four of which were financed by TD and RBC.

Court filings and an internal police report from the investigation indicated potential complicity by bank employees. Allegations emerged that bankers at TD and RBC had helped Figliomeni’s group launder proceeds of crime.

While no charges were pursued against the banks, these revelations raised further concerns about oversight and accountability.

Under Canadian law, banks are required to conduct rigorous checks on high-risk clients, particularly those with ties to organized crime.

However, experts argue that the enforcement of these rules has been lacklustre.Clement noted that banks could legally terminate client relationships if sufficient evidence of wrongdoing is established, even after accounts have been opened. “If [the banks] were misled by the individuals when they onboarded them, then they would have grounds, probably, to break it,” he said.

“But… five years-that seems a little long.”FINTRAC, which monitors banks’ compliance with anti-money laundering laws, also flagged instances where TD failed to act even after receiving production orders from law enforcement regarding suspicious clients.

Yet, the fines imposed on banks in Canada remain modest compared to international standards, prompting critics to call for stricter penalties to deter negligence.

The ongoing controversy poses significant reputational risks for TD and RBC. Both institutions are pillars of Canada’s banking sector, and their involvement in such high-profile cases undermines public trust.

The banks’ reluctance to fully disclose the terms of their continued relationships with Figliomeni only fuels speculation about the adequacy of their internal controls.

“This is not just a failure of systems; it’s a failure of responsibility,” Clement said. “When banks allow their services to be exploited by criminals, they become part of the problem.”

As TD and RBC face increasing scrutiny for their dealings with Angelo Figliomeni, the case highlights systemic challenges in ensuring accountability within Canada’s banking sector.

The revelations underscore the need for stricter oversight, enhanced penalties, and greater transparency to restore public confidence in financial institutions.

Until meaningful reforms are enacted, the specter of criminal exploitation will continue to cast a shadow over Canadian banks.