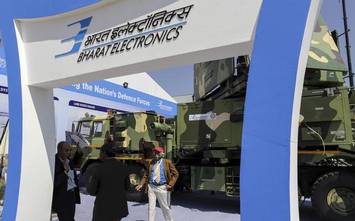

BEL To Grow with Defence Indigenisation Initiative

Dated : 16 Dec 2020 (IST)

Bharat Electronics Ltd (BEL) a defence Navratna have been in limelight with the government’s increasing emphasis on ‘Atmanirbhar Bharat’. The standoff with China and the current international security paradigm means that India has no option but hike its defence allocation.

With emphasis on indigenisation, it means that companies like Bharat Electronics (BEL) a leading defence electronics manufacturer will have a very healthy order book, The stock price of this Company therefore, not only has more than doubled since the lows of March but continues to gain. With a nearly 4% rise in early deals on Monday, the BEL stock is near its 52-week high.

Sentiment on Monday also got a boost with a foreign brokerage house maintaining its strong view on BEL. Better-than-expected September quarter performance, strong order inflows, and firm growth guidance are among the key reasons for brokerages maintaining their positive stance.

The company had reported 20% revenue growth during the quarter ended September with operating margins at around 19%, defying lockdown-related execution challenges.

The first half of FY21 was witness to ₹5,000 crore worth of order inflows, with expectations of ₹15,000 crore worth of orders during FY21. The actual number can nevertheless beat expectations.

Of the 101 defence equipment items banned for import by the defence ministry, BEL is capable of taking care of 55. The company has submitted an expression of interest (EoI) and 23 items are under advanced stages of indigenisation, say analysts.

Thus, an increasing pace of indigenisation is driving prospects. Also, in the first batch of LRSAM (long range surface to air Missile systems), 35% of the content is indigenous.

This is expected to rise to 55% by the 11th batch, say analysts at Motilal Oswal Financial services. The first radar for the Rafale aircraft, which was integrated in France, too was supplied by BEL as an indigenous partner.

While most factors are favourable, execution holds the key. And even as the company has impressed the Street with its September quarter growth, quarterly results can be chunky as they are dependant on execution of specific projects, say analysts.

Credit Suisse is looking at flat turnover and earnings during FY21, and expects a pick-up from FY22.

The company has been dependant on large orders too, with order flows linked more to defence capex. Hence the scale-up of base order inflows is important. Also, order flows from other segments as smart city, homeland security orders, railway signalling, and automated gates for metro projects, medical equipment are important to improve the order-book mix.

At close to ₹118 apiece, the stock is trading 15-17 times one year forward earning estimates of various analysts.