Economic decline over next four years for China

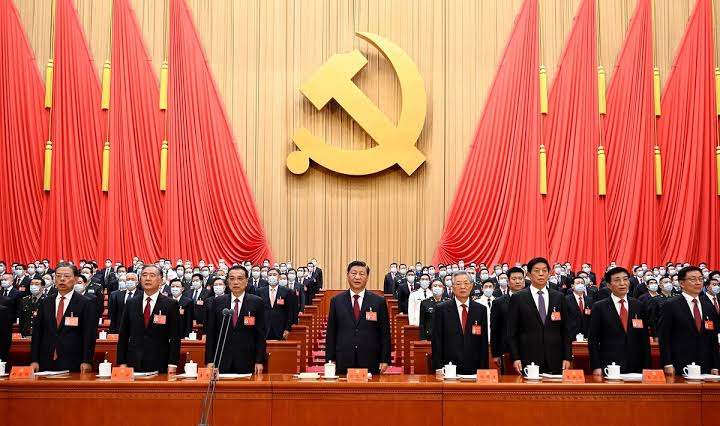

Chinese stocks are in tizzy. In a coaster riding week, they saw their worst performance in years. This happened despite efforts by Communist Economic experts to restore confidence in the economy and address the prolonged stock market decline that has seen a staggering disappearances of USD 6 trillion in value over three years.

The Shanghai Composite Index witnessed a significant 6.2 per cent drop, the most substantial weekly loss since October 2018, while the Shenzhen Component Index recorded an 8.1 per cent decline, marking its largest drop in three years. Year-to-date, both indexes have lost more than 8 per cent and 15 per cent, respectively.

The CSI 300 index, composed of 300 major stocks listed in Shanghai and Shenzhen, also suffered a 4.6 per cent decline, marking its worst week since October 2022, according to CNN report. The index is down 7 per cent since the beginning of the year.

The International Monetary Fund has predicted China’s economic decline to continue over the next four years as Beijing continues to tackle a range of challenges, including a rapidly aging population, higher unemployment and a property crisis.

In a report released on Friday, the IMF projected that China’s economic growth will reduce to 4.6 per cent this year, down from its 5.2 per cent growth in 2023, and drop further to 3.4 per cent by 2028.

The property market has been a particular area of trouble for the Chinese economy lately, with a Hong Kong court on Monday directing Chinese property giant Evergrande to liquidate.

According to IMF analysis released on Friday, the real estate investment is likely to see a drop from 30 per cent to 60 per cent in the next 10 years relative to 2022 levels.

The IMF report reads, “Absent a comprehensive restructuring policy package for the troubled property sector, real estate investment could drop more than expected, and for longer, with negative implications for domestic growth and trading partners.”

Christopher Tang, Senior Associate Dean of Global Initiatives at the University of California Los Angeles Anderson School and Faculty Director of the UCLA Centre for Global Management, stressed that the real estate crisis is closely related to Chinese consumers’ spending habits.

Christopher Tang stated, “As they see their equity in their home investment declining, they spend less on everything – lower consumer spending, the demand falls which reduces production and hence slower economic growth.”

Tang added, “There is a domino effect when the real estate market is so huge and intertwined with decades of aggressive housing development and easy lending from banks.” Tang stressed that China needs to promote new demand-side economic policies and ease market regulations.

The IMF suggested the Chinese government to encourage its citizens to find new means of investment and make market-oriented reforms to boost the economy of China.

Ali Wyne, the senior research and advocacy adviser for US-China at the think tank International Crisis Group, suggested that local government debt and tensions between China and Western nations are also reasons behind the predictions of the Chinese economic downturn.

In an email statement Wyne stated, “The evidence thus far does not suggest that a hard landing is in the offing, but it does suggest that China’s growth headwinds are more intractable than they were a decade ago or even at the outset of the 2020s.”