Monthly inflation rate in Pakistan crosses 28%

There is acute economic crisis in Pakistan, even the caretaker government has revised its projection, stating that inflation may remain around 28.5 per cent in January due to food supply shocks.

This comes two days after the central bank in Pakistan raised its inflation forecast.

In its flagship monthly economic outlook report, the Pakistan finance ministry anticipates inflation to be around 27.5 per cent -28.5 per cent in January, a 3.5 per cent increase from the previous forecast made a month ago. This adjustment reflects ground realities, indicating no relief in the prices of essential goods and utility items. The report, prepared by the Economic Advisor Wing of the finance ministry, also suggests that the inflation rate may remain around 27.5 per cent in February.

The Pakistan-based news daily reported that this report follows the central bank’s recent announcement of its monetary policy, which tempered earlier optimism about a sharp decline in inflation in the second half of the fiscal year. Price stability is the central bank’s primary objective under the new autonomy regime, but there is no accountability for missing the goal.

The State Bank of Pakistan appears to attribute the failure to achieve inflation targets to the federal government. It stated on Monday that frequent and substantial adjustments in administered energy prices have impeded the anticipated decline in inflation, affecting near-term outlook. The central bank now expects average inflation to fall in the range of 23 per cent-25 per cent in FY24, a higher range than initially projected and even surpassing the IMF’s forecast, The Express Tribune reported.

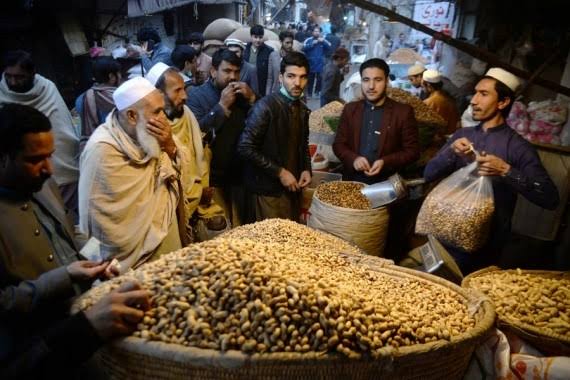

The finance ministry cites elevated prices of perishables and vegetables, along with increased electricity and gas costs, as contributors to inflationary pressure. The surge in onion export orders following the Indian ban has strained local supply, raising domestic prices. Additionally, severe weather disruptions have led to price hikes for commodities like tomatoes, and reduced chicken supply from controlled sheds facing higher input costs has impacted chicken prices.

Nevertheless, the government has implemented measures to address these challenges, such as increasing the minimum export price for onions and lifting the ban on soybean imports to improve the supply situation for perishables and chicken.

In January FY2024, there is a slight moderation in the inflation outlook compared to the preceding month. While challenges persist in the form of supply chain disruptions and increased utility prices, the decline in fuel costs offers a promising counterbalance, potentially mitigating the overall impact on consumers and production sectors.

The Express Tribune reported that the finance ministry’s report notes that during the first half of this fiscal year, “economic stabilisation” has been achieved through effective measures and prudent policies. Despite challenges, external stability is evident from a surplus in the current account in December. On the fiscal side, revenue performance is encouraging, but there is significant pressure on expenditures due to higher markup payments.

The key challenge is higher markup payments resulting from the high policy rate, leading to a sharp rise in current expenditures, according to the finance ministry. The budget deficit during the first half of the fiscal year widened by over 50 per cent, contradicting claims of achieving fiscal stability. The massive increase in the deficit is primarily attributed to interest costs, as highlighted by the finance ministry.

To address the challenge of higher current expenditures, the government is focusing on controlling non-markup spending through austerity measures, resulting in a rise in the primary surplus during July-December FY2024. However, mounting markup payments in response to high policy rates are expected to keep expenditures under pressure during the current fiscal year, it said.

The Ministry of Finance expects economic activities to strengthen further during the second half of FY2024, contingent on the continuation of sound and prudent economic policies aimed at achieving the set growth target for the fiscal year. The upward trend is attributed to revived domestic economic activities and better export demand in Pakistan’s main export markets, contributing to external sector stability. The ministry anticipates that ongoing developments and policies to increase exports and remittances will translate into an improved trade balance and current account during the second half of FY2024.

At the domestic level, despite persistent challenges, the industrial sector is showing signs of recovery, and government measures to stimulate growth, particularly in SMEs, are providing impetus. The revival of industrial sector activities is visible in the cyclical LSM pattern for the month of November, reaching the potential level.