Nigeria cracks down on cybercrime network targeting global cryptocurrency and romance scams

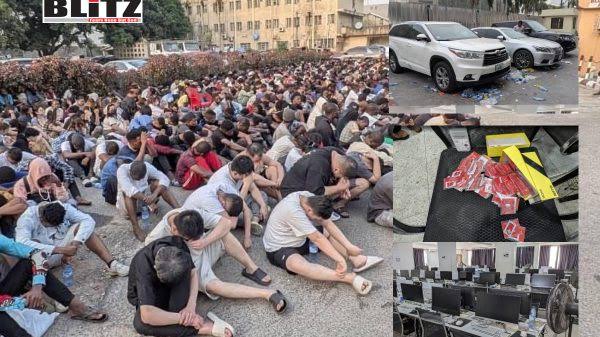

In a significant crackdown on cybercrime, Nigeria’s Economic and Financial Crimes Commission (EFCC) has arrested 792 individuals, including a notable number of foreign nationals, for their involvement in cryptocurrency investment fraud and romance scams.

The arrests were made on December 10 at a facility in Lagos, Nigeria’s bustling commercial capital, where the perpetrators operated a sophisticated fraud network.EFCC spokesperson Wilson Uwujaren announced on December 16 that the apprehended individuals included 148 Chinese nationals, 40 Filipinos, two Kazakhstanis, a Pakistani, and an Indonesian.

These foreign criminals were reportedly the masterminds behind a far-reaching scam that preyed on individuals-predominantly women-across North America, Europe, and parts of Latin America.

The fraudsters operated out of the “Big Leaf” building in Lagos, which acted as their base of operations. Uwujaren revealed that the foreign nationals had turned the facility into a training ground for their Nigerian accomplices, teaching them how to lure unsuspecting victims through online platforms.

The fraudsters used a combination of romance bait and promises of cryptocurrency investment opportunities to manipulate their targets into handing over large sums of money.

“The Nigerian accomplices were recruited by the foreign kingpins to prospect for victims online through phishing,” Uwujaren explained. “They targeted mostly Americans, Canadians, Mexicans, and several others from European countries.”

Once the Nigerian recruits gained the trust of their victims, they would pass the details on to the foreign nationals, who would then carry out the financial scams.

According to Uwujaren, these criminals capitalized on emotional manipulation to push their victims into making fraudulent investments, often involving cryptocurrencies.

The EFCC disclosed that the syndicate employed modern communication tools to target individuals. Local Nigerian staff would initiate contact through popular social media platforms such as Instagram, Telegram, and WhatsApp, as well as messaging services that allowed them to mask their identities using foreign telephone numbers.

The process often began with simple, innocent conversations aimed at building trust with their victims. Over time, the fraudsters escalated their schemes, weaving intricate stories to entice victims into “investment opportunities” that appeared legitimate.

The promise of high returns on cryptocurrency investments was particularly alluring for victims unfamiliar with the intricacies of digital finance.

“Once the Nigerians are able to win the confidence of would-be victims, the foreigners would take over the actual task of defrauding them,” Uwujaren stated.

The authorities seized significant evidence during the raid, including desktop computers, mobile phones, laptops, vehicles, and around 500 local SIM cards purchased specifically for criminal purposes.

Investigators are working to trace the money trails and identify potential international connections to other organized fraud syndicates.

Internet fraud, commonly known as “419 scams”-a reference to the section of Nigeria’s criminal code that deals with fraud-has long been a persistent problem in the country.

Over the years, Nigerian scammers have built a notorious reputation for email phishing schemes, fake lotteries, and fraudulent business proposals.

However, the rise of cryptocurrency has added a new dimension to cybercrime, allowing fraudsters to exploit the decentralized and largely unregulated nature of digital currencies.

A Cybercrime Index report published in April by researchers from the University of Oxford ranked Nigeria fifth among countries with the greatest cybercriminal threat.

This report underscores the scale of the challenge that Nigerian authorities face as they work to combat an evolving landscape of digital fraud.Nigeria’s “unfortunate reputation” as a hub for cybercrime has also attracted international fraud networks looking to exploit local conditions.

The EFCC, in its recent statement, lamented how foreign criminals have used this perception to “establish a foothold” in Nigeria for their own illicit enterprises.

The role of social media platforms in enabling these scams has also come under increasing scrutiny. In July, Meta-the parent company of Facebook, Instagram, and WhatsApp-announced it had removed around 63,000 Instagram accounts in Nigeria that were involved in financial sextortion schemes.

The company revealed that it had also shut down a coordinated network of over 2,500 accounts actively targeting individuals with similar scams.

Meta’s crackdown extended to Facebook as well, where it removed 1,300 accounts, 200 pages, and 5,700 groups based in Nigeria.

These pages and groups reportedly shared tips and strategies for running fraudulent schemes, further highlighting the organized nature of cybercrime operations in the region.

Despite these efforts, social media remains a vital tool for scammers to reach a global audience. The ease of creating fake profiles, the anonymity provided by messaging platforms, and the global reach of these tools make them ideal for fraudulent activities.

The EFCC emphasized that it is collaborating with international partners to investigate the full extent of the scam, including the possibility of links to other organized fraud networks.

Given the multinational nature of the operation, cooperation with foreign law enforcement agencies is critical to dismantling the wider criminal infrastructure.

“The anti-graft agency is working with foreign partners to establish the extent of the scam and accomplices, as well as the likelihood of any collaboration with organized international fraud cells,” Uwujaren stated.

The victims of these scams, many of whom were emotionally manipulated, often face significant financial and psychological repercussions.

Romance scams are particularly devastating because they combine financial loss with emotional betrayal.

Many victims are reluctant to come forward out of embarrassment, further complicating law enforcement efforts to quantify the scale of such fraud.

Cryptocurrency scams, meanwhile, prey on the growing interest in digital finance and the promise of quick wealth. For many victims, the technical complexity of cryptocurrency transactions makes it difficult to trace or recover lost funds.

The EFCC’s successful operation serves as a reminder of the need for stronger international collaboration to combat cybercrime. It also highlights the importance of digital literacy for individuals, particularly when engaging with online financial opportunities or relationships.

Experts stress that raising awareness about common scam tactics can help individuals protect themselves from becoming victims.

Social media platforms, governments, and financial institutions must work together to educate users about the dangers of online fraud and implement stronger safeguards to detect and prevent such activities.

Nigeria’s recent crackdown is a significant step in addressing the cybercrime epidemic, but the persistence of these scams underscores the need for sustained efforts.

As digital communication and cryptocurrency continue to evolve, so too will the tactics of those seeking to exploit them.

Combating this issue will require vigilance, cooperation, and proactive measures at both local and global levels.

For now, the EFCC’s operation has dealt a significant blow to one network of fraudsters, sending a strong message that Nigeria is not a safe haven for cybercriminal enterprises.

Whether this momentum can be sustained in the fight against international cybercrime remains to be seen.

Source: Blitz