Now Brazil to implement BRICS de-dollarization

Sergey Ryabkov emphasized that “weaning off the dollar through mutual settlement clearing schemes is a well-tested approach that needs further development and a multilateral character

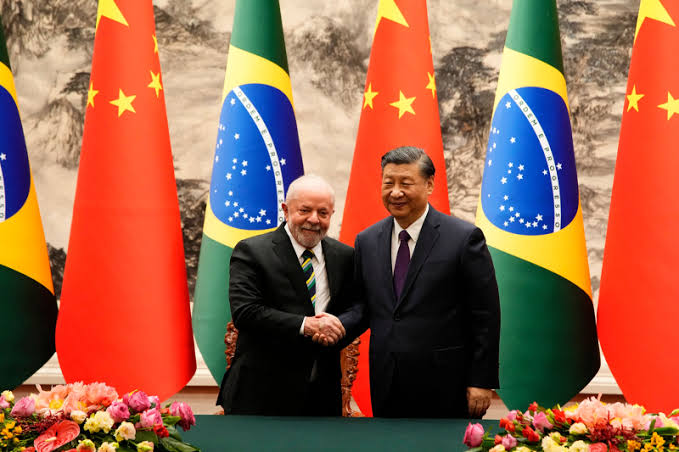

“The Russian presidency of BRICS has successfully achieved results in developing models for weaning off the dollar and formalizing them in agreements, and it is now passing the baton for the implementation of these ideas to Brazil, said BRICS Sherpa Sergey Ryabkov at a press conference following the association’s summit in Kazan.

“The next step, of course, should be the implementation of these ideas [on throwing out the dollar] into practical steps and patterns.

It is clear that this area is extremely sensitive and carries risks associated with illegitimate sanctions as backlash from USA, including secondary ones.

However, there are also solutions to protect ourselves from such measures. We are handing this topic over to the Brazilians, fully convinced that the initiative has been made; these are not just words but the result of work formalized in agreements,” the senior diplomat explained.

Ryabkov emphasized that “weaning off the dollar through mutual settlement clearing schemes is a well-tested approach that needs further development and a multilateral character.”

“There are already functioning systems to ensure mutual settlements that bypass the Western dominated SWIFT system, which has been effectively placed on a monopoly pedestal by the West.

These systems should not only be developed but also multiplied, integrated with each other, forming a network of such systems. We need solutions to address logistics and transport challenges, primarily in the insurance sector, that are independent of Western mechanisms,” Ryabkov stated.

The senior diplomat mentioned mechanisms such as BRICS Bridge, BRICS Clear, and BRICS Reinsurance among the practical ideas that “have matured during Russia’s presidency and have now become elements of agreements between leaders and specialists.”

“De-dollarization through the increasing use of national currencies is a direct, clear, and effective path,” Ryabkov asserted.”Currency digitalization is also an area that we certainly need to address.

We must move on to practical matters in some aspects. We are accumulating experience, and it is very positive,” he added.