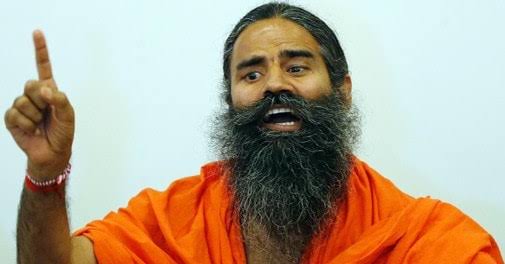

Patanjali struggles to arrange Rs 4,000 crore loan for Ruchi Soya acquisition

Patanjali Ayurved is finding it tough to arrange Rs 4,000 crore loan from banks for its Ruchi Soya acquisition, reported Business Standard.

Lenders are unwilling to provide the loan since a rating firm downgraded Patanjali’s debt earlier this month citing a lack of corporate guarantee offered by the parent firm for the loan.

While the rating agency, CARE Ratings, subsequently withdrew the rating and issued a no-objection certificate following Patanjali’s request, the damage, it seems, has already been done.

The entire development has raised questions about the viability of the repayment of the loan, a person aware of the development was quoted as saying by Business Standard. Patanjali Ayurved’s spokesperson wasn’t available for comment on Tuesday.

Initially, the plan put forward for the acquisition envisaged that the banks would take a 65 percent cut on Ruchi Soya’s dues — which amount to Rs 12,100 crore — the report said.

Of the Rs 4,350 crore loan offer, the lenders will receive Rs 4,240 crore of their dues while the remaining Rs 110 crore will be invested in Ruchi Soya for expansion after the acquisition by Patanjali, the report said.

The development is a setback to the proposed Ruchi Soya acquisition that was given green signal the National National Company Law Tribunal (NCLT) in July. However, the deal seems to have stuck a logjam.