Power struggle within the Chinese politburo

There is a widespread discontent in China triggered by China’s dynamic zero-Covid policy. This has brought a schism within the Communist Party of China’s core leadership with its immediate impact on plans and policies which were hitherto described as game-changer.

It started with the fiasco brought about by the incompetent Theatre Commander of Western Theatre. His plans to make further incursions in to Ladakh backfired very badly in the Galwan Valley. The Indian Army gave a bloody nose to the PLA. Soon the Commander was sacked unceremoniously. Two more Commanders were sacked in quick succession thereafter as they could nothing to salvage the situation.

Next followed the exodus of the Multi Nationals from the manufacturing hubs of China. It started with a trickle but became torrential soon. The final straw was the Wuhan virus and the severe prolonged lockdown.

Then Xi clamped down on China’s big tech companies like Tencent and Alibaba, food delivery app Meituan, ride-hailing app Didi and numerous online gaming and private tutoring apps–all this in the name of bringing “common prosperity” to China.

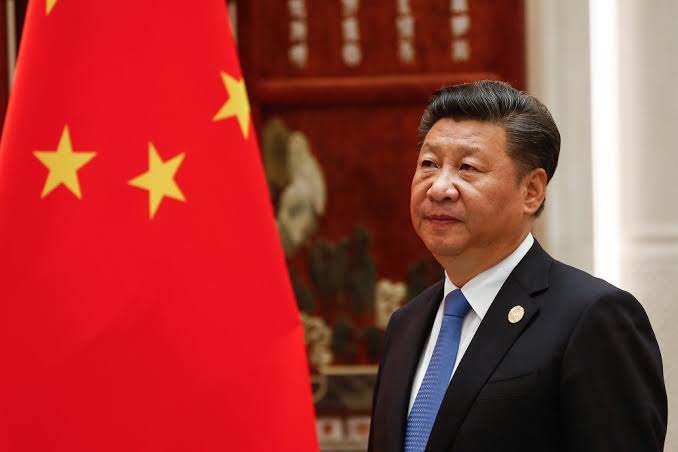

Such moves, whose prime objectives were to close the wealth gap by encouraging high-income individuals and businesses to give back more to society, were seen as President Xi Jinping’s efforts to consolidate his power ahead of the 20th Party Congress of the CPC, scheduled for 2022 end.

But then the cost of the crackdown was so huge that its effect paled President Xi Jinping’s anticipation, reported Tibet Press. China’s economy has slowed to a grinding halt, not seen since the 1990s. The Economist estimated that the crackdown wiped out more than USD 1 trillion worth of collective market capitalization of China’s largest internet groups.

Overall, the destruction caused to tech companies under the regulatory mechanism and dynamic zero-Covid policy has translated into larger fears of an unemployment wave in China, a factor which was seen during the state sector reforms of the late 1990s, reported Tibet Press.

It has also led to driving away global investors. In this regard, Russia’s invasion of Ukraine has also had a great impact. Norway’s USD 1.3 trillion sovereign wealth fund has declined to invest in a Chinese sportswear giant; the UK-based investment firm, Artemis Investment Management LLP has sold all its China investments; Germany’s Fraport AG has sold its stakes in Xi’an Airport to a local buyer, ending a 14-year stint in China, reported Tibet Press.

Moreover, the International Monetary Fund has already slashed the growth forecast for China to 4.4 per cent, down from 4.8 per cent.

Xi Jinping’s much-touted politico-economic campaign “common prosperity” which otherwise led to unleashing a storm of regulatory activity has been put on the back burner because China’s economy is under huge strain, reported Tibet Press.

China’s top leadership is in grip of feverish factional war as President Xi Jinping is shelving his key political and economic campaigns and Premier Li Keqiang has been brought back at the forefront to revive the economy.

President Xi, hailed as the tallest leader in the country has been left to fend for himself at a time when the brutal zero-Covid policy has impacted the country with the economy in haywire and, no end in sight of rabid anti-China sentiments worldwide, reported Tibet Press.

For this, Premier Li Keqiang’s move to come out of his shell and his boldness to call into question some of the decisions of the President is cited as the reason.

Premier Li’s stand is that China needed down-to-earth policies, not grandiose plans like the “Chinese dream” till 2050 to become the economic power of the world.

While President Xi declared victory over poverty in China, Premier Li believes that extensive work is still needed to alleviate poverty in the country’s urban areas. Under his supervision, dozens of stimulus measures have been introduced to revive the economy, reported Tibet Press.

On June 2, Premier Li headed the State Council, and during its meeting asked state-backed banks to fund USD 120 billion for infrastructure projects and give some relief to local governments struggling with their fast-drying coffers.

And then what could be a major U-turn on the policy front, China is reportedly considering a revival of the Ant Group’s IPO.

Whether such moves have a ripple effect on the 20th National Congress of the CPC has to be seen. The National Congress is taking place later this year and it may herald leadership changes.

Against this backdrop, in the faction-ridden CPC, Premier Li’s recent moves are creating more headlines in the Chinese media, while President Xi Jinping is busy clearing the path for his third term in office.