US debt snowballs to unprecedented $35 trillion

‘A barrier lake that hangs above people’s heads’ raises concerns

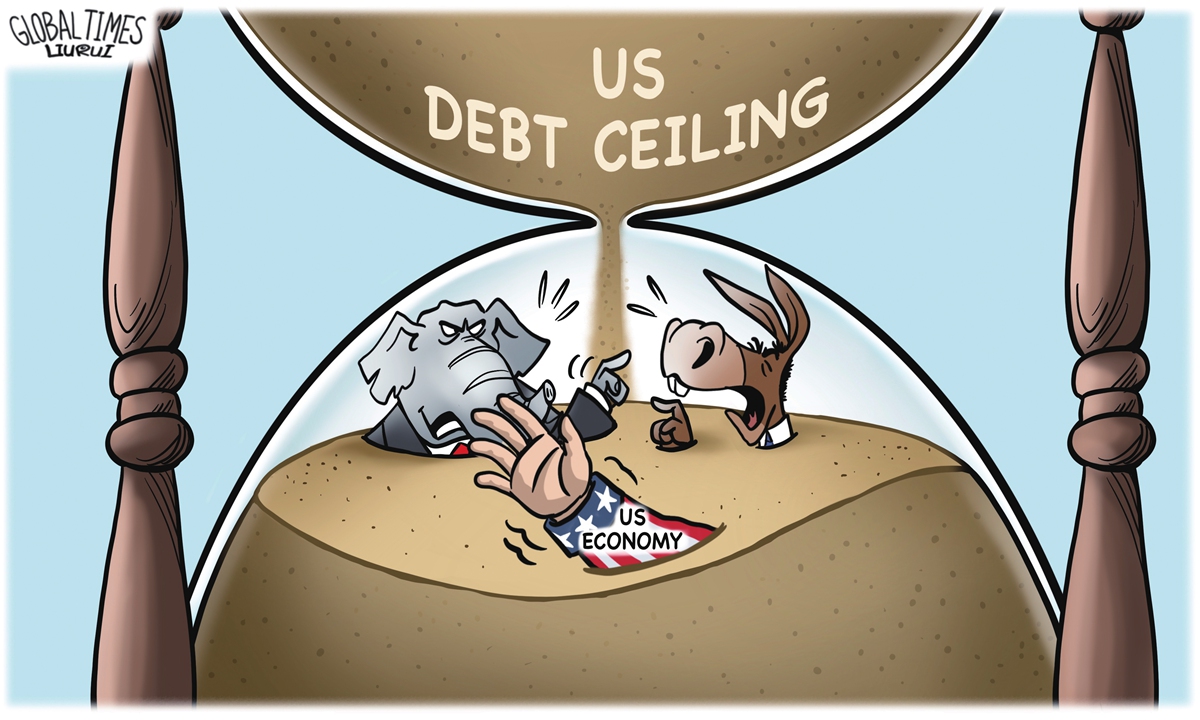

The US federal government’s public debt has skyrocketed at a breakneck pace to an unprecedented $35 trillion, smashing the record set just months ago and sending fresh worries to the global market. The reading once again reminded the world of the ticking time bomb it has to face as a result of a series of irresponsible decisions made by the US government.

Data from the US Treasury Department released on Monday afternoon (US time) showed that the gross national debt hit $35,001,278,179,208.67. That equates to $104,497 per person in the US.

The alarming milestone comes just months after the US eclipsed the $34 trillion threshold in early January 2024, while the $33 trillion mark was reached in September 2023, according to US media outlet Fox Business.

By comparison, the US national debt hovered around $907 billion just four decades ago.

The debt milestone has drawn fresh warnings from within the US.

“We are going to have to get serious about the debt, and soon. Election years cannot be an exception for trying to prevent completely foreseeable dangers – and the debt is one of the major dangers we are facing,” Maya MacGuineas, president of the nonpartisan Committee for a Responsible Federal Budget, said in a statement.

Analysts said that although the US could get away with the debt issue in the short and medium term with various arrangements such as constantly raising its debt ceiling, there are rising global concerns about the debt of the US and its selfish desire to expand it irresponsibly to meet immediate political and economic needs.

The ballooning US debt can be comparer to a barrier lake that hangs above the heads of everyone.

The world can only be sure about one thing, that is, there is no telling how the US will deal with its rising national debt in the end, and what the consequences of these measures will be. The rest of the World must stay alert to the possibility of a US financial crisis, or even an economic crisis stemming from its rising debt.

The growing market worries over the debt have caused many US debt holders to lose confidence, and many have begun to slash their holdings in recent years, a process exacerbated by Washington’s weaponization of the dollar to wage sanctions against a number of countries.

Emerging markets are particularly vulnerable, as possible rising yields of US debt will indirectly raise the costs of servicing their debt, These countries face the dangers of currency devaluations, capital outflows and imbalances in their international payments due to the abuse of America’s financial hegemony.

Observers said that the rapid increase in US debt was caused by the spending spree of the US government following the COVID-19 pandemic, while there had been no notable increase in US government revenue, resulting in a widening fiscal deficit.

The next US president will face fiscal deadlines that loom next year, with one of the first such deadlines to arrive on January 1, when the current suspension of the debt limit is set to expire. By then, US lawmakers will be forced to debate another increase or suspension of the debt ceiling and potentially fiscal reforms, while the Treasury Department uses “extraordinary measures” to avoid a default for a period of several months.

In June 2023, the US Congress approved the 103rd debt ceiling raise in the country since 1945 after months of partisan arm-wrestling. The bill allowed the US government to avert a debt default by borrowing more.

Analysts added that the issue of piling up debt will further damage the US dollar’s status as the global reserve currency, which is already showing worrying signs.

US Treasury Secretary Janet Yellen warned earlier in the month, testifying before the House Financial Services Committee, that one of her concerns is how best to protect the international status of the US dollar as US financial sanctions have pushed more countries to seek alternative financial transaction methods that do not involve the US dollar, according to media reports.

The world can only hope that the US takes a responsible attitude to fix its debt issue and build a ‘dam around the barrier lake’ to make it a reservoir. However, such a hope may be a long shot. The toxic political environment in the US has meant that any serious effort to aggressively slash the government’s spending is unlikely.

Given that the dollar still enjoys short-term hegemony amid slowing global economic growth and rising geopolitical tensions, the more likely scenario would be that the US government continues down the path of widening its fiscal deficit and keeps its snowballing debt unchecked.