US Economy is reaping benefits from the Ukraine Crisis

The US-led Western block announced a series of sanctions against Russia on Sunday, shaking stocks, currencies and futures across global markets.

Brent crude futures rose to $98.11 a barrel in London on Monday, up 4.4 percent. The price of gold exceeded $1,900 an ounce while the euro and pound fell 1.25 percent and 0.6 percent, respectively, against the US dollar. The offshore Chinese yuan fell 145 basis points against the dollar and the Russian currency plunged from 83 rubles on February 25, to 117 rubles per dollar three days later.

The risk aversion of capital markets increased sharply with capital clearly flowing to the US. Foreign financial analysts noted that on the currency front, the US dollar is now the “King” which can provide liquidity and hedge risks at the same time.

The beneficiary of all the current turmoil in global markets is the US while the Russia-Ukraine conflict looks to be exactly aligned with US’ interest.

How US benefits from Ukraine crisis

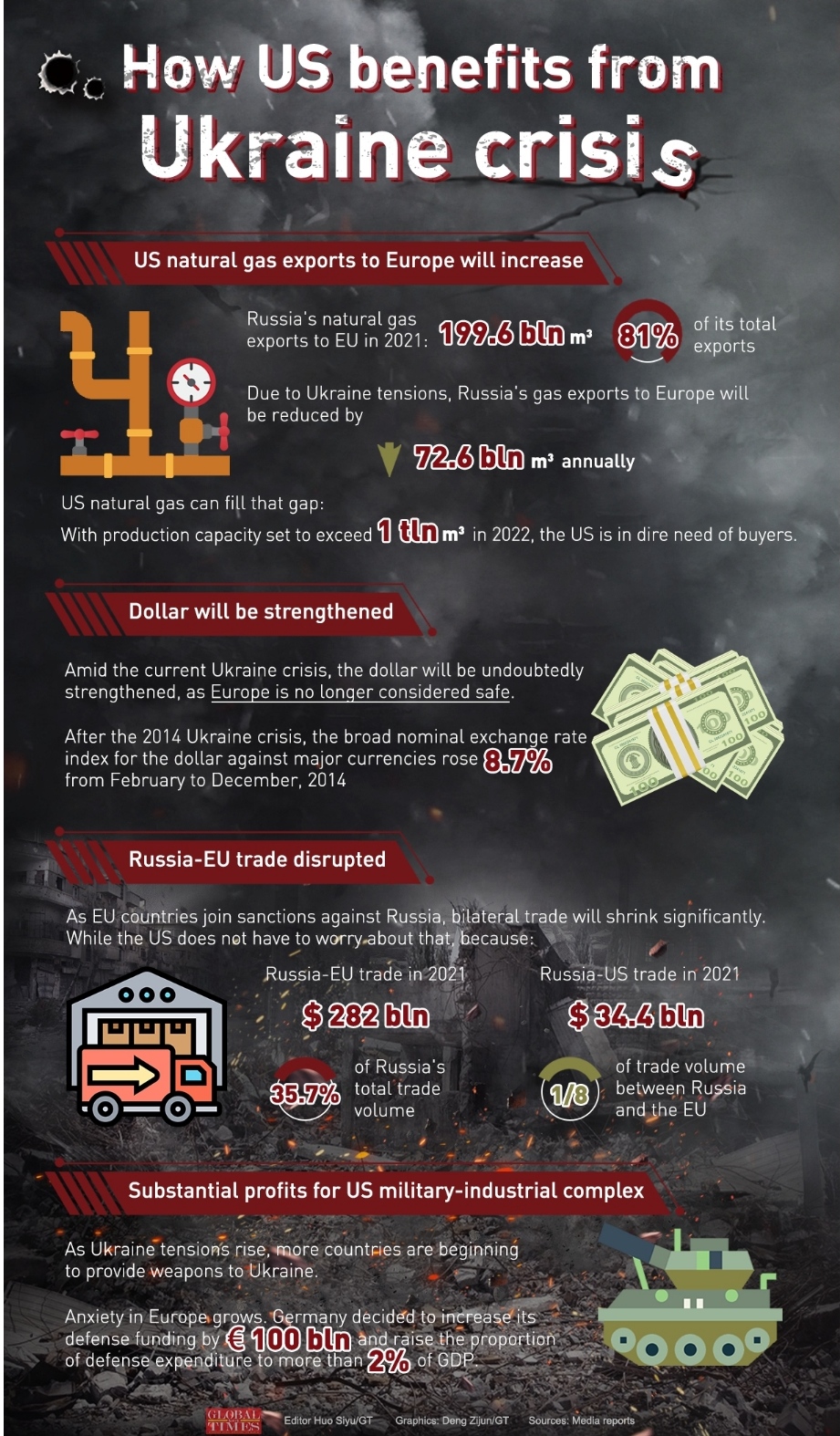

First, the crisis has greatly increased US’ natural gas exports to the Europe which used to purchase more than 40 percent of its gas from Russia. In 2021, Russia’s natural gas exports to the EU amounted to 192.6 billion cubic meters, accounting for 81 percent of its total exports. The gas was mainly delivered by pipeline through Ukraine and the Nord Stream 1, which have both been cut off after the conflict broke out. Additionally, the Nord Stream 2 deal is now dead.

Adding to the SWIFT sanction against certain Russian banks, gas exports to Europe will shrink sharply and the US, which has recorded a surge in gas production in recent years, is ready to fill the gap.

Second, the crisis will strengthen the US dollar and attract global capital flows. All the geopolitical crisis the US has created or actively instigated over the past two decades, without exception, have strengthened its currency. In the wake of the Russia-Ukraine conflict, the value of the dollar will be boosted making the US a financial sanctuary since Europe is no longer safe.

Third, the crisis has disrupted bilateral trade between Russia and the EU, Russia’s largest trading partner. As EU members join to sanction Russia and some Russian banks are excluded from the SWIFT system, bilateral trade will shrink significantly which is exactly what the US needs.

Moreover, the crisis could also hugely benefit the American military-industrial complex. As the conflict continues, the US, Germany and other NATO countries are providing weapons to Ukraine. And more importantly, it has created great anxiety among European countries about the continent’s security, subsequently increasing their dependence on NATO, and ultimately on the US.

To better understand the impact of these measures one must take a look at the history and background of the situation in Ukraine. After pledging not to expand “one inch” eastward when the Soviet Union disintegrated in 1991, NATO has, however, move eastward on repeated occasions. Almost all the European countries to the west of Russia, with the exception of Belarus and Ukraine, are already NATO members. Instead of a defensive organization, NATO is in fact a huge offensive bloc.

Why, regardless of Russia’s request, is the US still refusing to make concessions and promise not to include Ukraine in NATO?

The truth is that the US needs this crisis, although these economic factors do not entirely explain why the US needs the conflict. More importantly, the crisis is in line with the US’ geopolitical interests and its hegemonic position. Understanding the economic drivers behind the situation could help us to have a clear picture about the nature of the crisis.

Currently, the Russian and Ukrainian sides have started negotiations and it is hoped that a balanced peace agreement, that takes into account the security interests of all parties, can be reached soon. All countries should make efforts to promote world peace.

Global Times